Using a loan settlement calculator can help you estimate the potential savings or costs associated with settling a loan for less than the full amount owed. Here’s how you can effectively use a loan settlement calculator:

1. Gather Information:

– Original Debt Amount: Know the total amount of debt you currently owe.

– Interest Rate: Understand the interest rate being charged on your debt.

– Current Payment Status: Whether you are behind on payments or negotiating proactively.

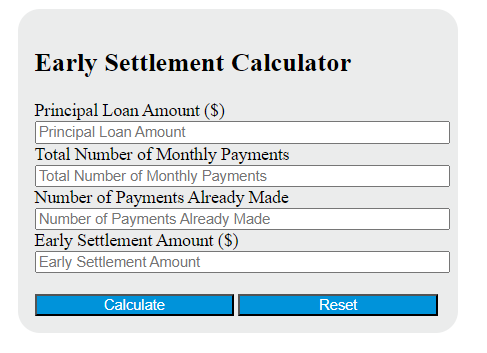

2. Input Data:

– Debt Details: Enter the total amount of debt you owe.

– Negotiated Settlement Percentage: Estimate or input the percentage of the debt that you expect to settle for. This is typically less than the full amount owed.

– Other Fees or Costs: If there are any additional fees or costs associated with the settlement, input those values if applicable.

3. Calculate:

– Click on the calculate button or perform the calculation based on the provided formula within the calculator.

4. Review Results:

– Estimated Settlement Amount: The calculator will provide you with an estimated amount you would need to pay to settle the debt.

– Savings: It will also show you the potential savings compared to paying off the debt in full.

– Impact on Finances: Consider how this settlement amount fits into your budget and financial plan.

5. Compare Options:

– Use the calculator to compare different settlement percentages or scenarios to see which option provides the best financial outcome.

– Evaluate whether settling the debt aligns with your overall financial goals and situation.

6. Consultation and Decision:

– While a calculator can provide estimates, it’s crucial to consult with a financial advisor or credit counselor for personalized advice and to understand the potential impacts on your credit score, taxes, and future financial options.

Loan settlement calculators are available online through financial websites, debt management companies, or credit counselling agencies. They provide a valuable tool for individuals considering debt settlement as an option but should be used alongside professional guidance to make well-informed decisions.

Also Read- https://settleloan.in/blog/settleloan/dealing-with-debt-collectors-how-loan-settlement-can-help/

Get in touch with us today at www.Settleloan.in and embark on your path to financial freedom